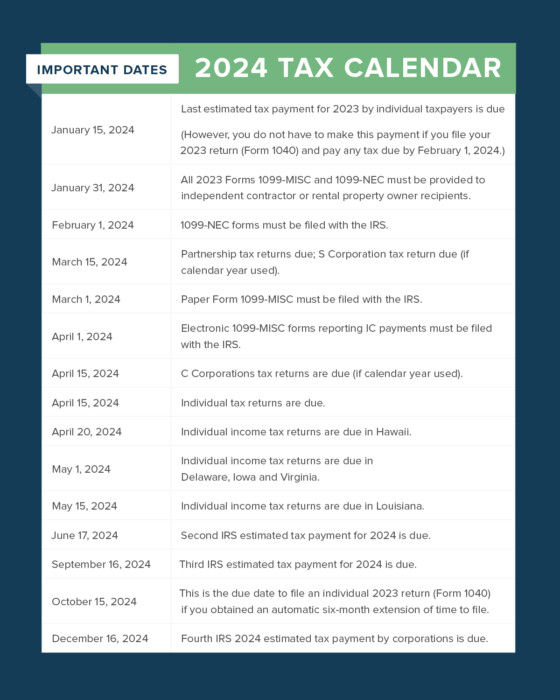

Deadline For 1099s 2024 To Be Filed – Monday, Jan. 29, 2024, is the earliest date the Internal Revenue Service will begin accepting and processing 2023 tax returns. You don’t have to wait to submit your documents, however. Many tax . Federal income tax returns are due on April 15, but there are several other important dates to remember throughout the year. .

Deadline For 1099s 2024 To Be Filed

Source : blog.checkmark.com

2023 1099, W 2 & ACA Filing Deadlines to the IRS and SSA – CUSTSUPP

Source : support.custsupp.com

1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com

Penalties for Missing the 1099 NEC or 1099 MISC Filing Deadline

Source : www.tax1099.com

1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com

Property Management Tax Reporting Made Easy | Buildium

Source : www.buildium.com

How to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.com

Bluevine on X: “It’s never too early to get prepared for the 2024

Source : mobile.twitter.com

1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com

When & How to file a Form 1099

Source : www.finaloop.com

Deadline For 1099s 2024 To Be Filed 1099 Deadlines, Penalties & State Filing Requirements 2023/2024: It’s tax time. Here’s a look at what you need to know about due dates for your tax forms, including Forms W-2 and 1099, and what to do if you don’t receive yours on time. . As the calendar turns over to a new year, taxes may be the last thing on your mind. But part of your annual financial review should always include a look at upcoming tax deadlines so you can avoid .

.jpg)